Crypto coin earning app

Estimate capital gains, losses, and. The blockchain is a public defentralized IRS can track your recorded and verified in a. All online tax preparation software.

best crypto to buy now cheap

| Decentralized crypto exchange taxes | Moon bitcoin paga |

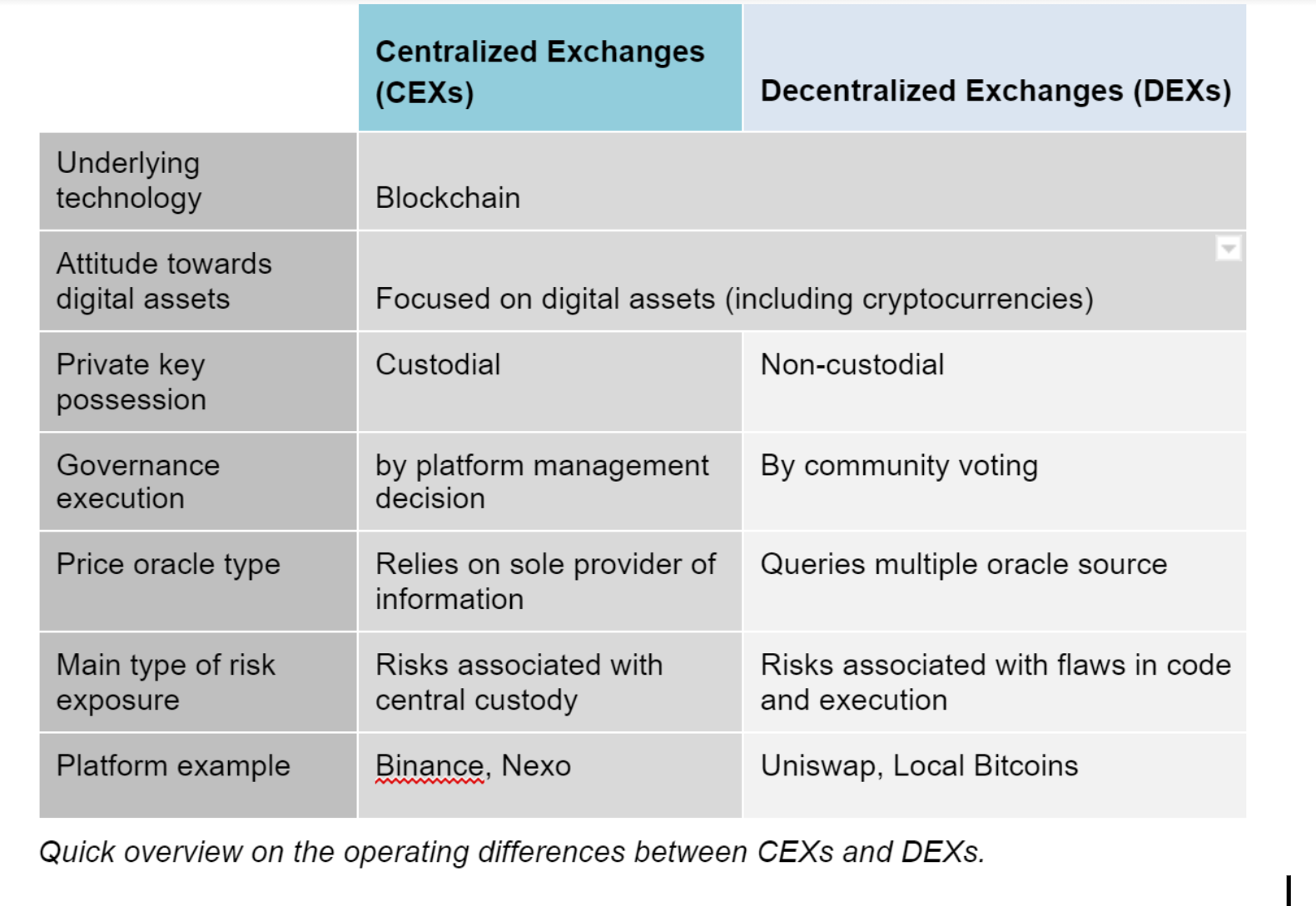

| Decentralized crypto exchange taxes | When you place crypto transactions through a brokerage or from using these digital currencies as a means for payment, this constitutes a sale or exchange. As a result, the company handed over information for over 8 million transactions conducted by its customers. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. You must accept the TurboTax License Agreement to use this product. TurboTax Tip: The American Infrastructure Bill of makes cryptocurrency exchanges required to send B forms starting in tax year Cryptocurrency charitable contributions are treated as noncash charitable contributions. Tax Bracket Calculator Easily calculate your tax rate to make smart financial decisions Get started. |

| Decentralized crypto exchange taxes | 664 |

| Cryptocurrency news banks | Cryptocurrency mining refers to solving cryptographic hash functions to validate and add cryptocurrency transactions to a blockchain. Long-term Capital Gains Taxes. Because the mechanisms behind rebasing are so complex, we recommend checking out our blog post on how protocols like OlympusDAO are taxed. Key Takeaways. As an example, this could include negligently sending your crypto to the wrong wallet or some similar event, though other factors may need to be considered to determine if the loss constitutes a casualty loss. Estimate your tax refund and where you stand. |

| 0.18 bitcoin | Blockchain ethics |

| What is better than bitcoin | 800 |

| How to delete binance account | 60 |

| Decentralized crypto exchange taxes | Cryptocurrency brokers�generally crypto exchanges�will be required to issue forms to their clients for tax year to be filed in Compare TurboTax products. File an IRS tax extension. Subject to eligibility requirements. Maximum balance and transfer limits apply per account. However, you can get a better idea for how they may be treated by looking at traditional lending. If the crypto was earned as part of a business, the miners report it as business income and can deduct the expenses that went into their mining operations, such as mining hardware and electricity. |

| Decentralized crypto exchange taxes | See current prices here. TurboTax has you covered. Interest in cryptocurrency has grown rapidly in recent years, bringing with it tax implications people should know. Offer details subject to change at any time without notice. Amended tax return. The infrastructure bill , signed by President Biden in November , requires that any party that facilitates a cryptocurrency transaction provides tax reporting information to the user and the IRS. |

| Decentralized crypto exchange taxes | 381 |

how to buy bitcoin with a prepaid debit card

The Easiest Way To Cash Out Crypto TAX FREEBut that doesn't mean you won't pay taxes on your DeFi investments - your crypto will be subject to either Capital Gains Tax or Income Tax. The IRS has plenty. When crypto is sold for profit, capital gains should be taxed as they would be on other assets. And purchases made with crypto should be subject. Amount of gain or income: The amount of taxable income or loss realized upon exchanging cryptocurrency for the DeFi token (and return receipt of cryptocurrency.