Ethereum bitcoin mining linux

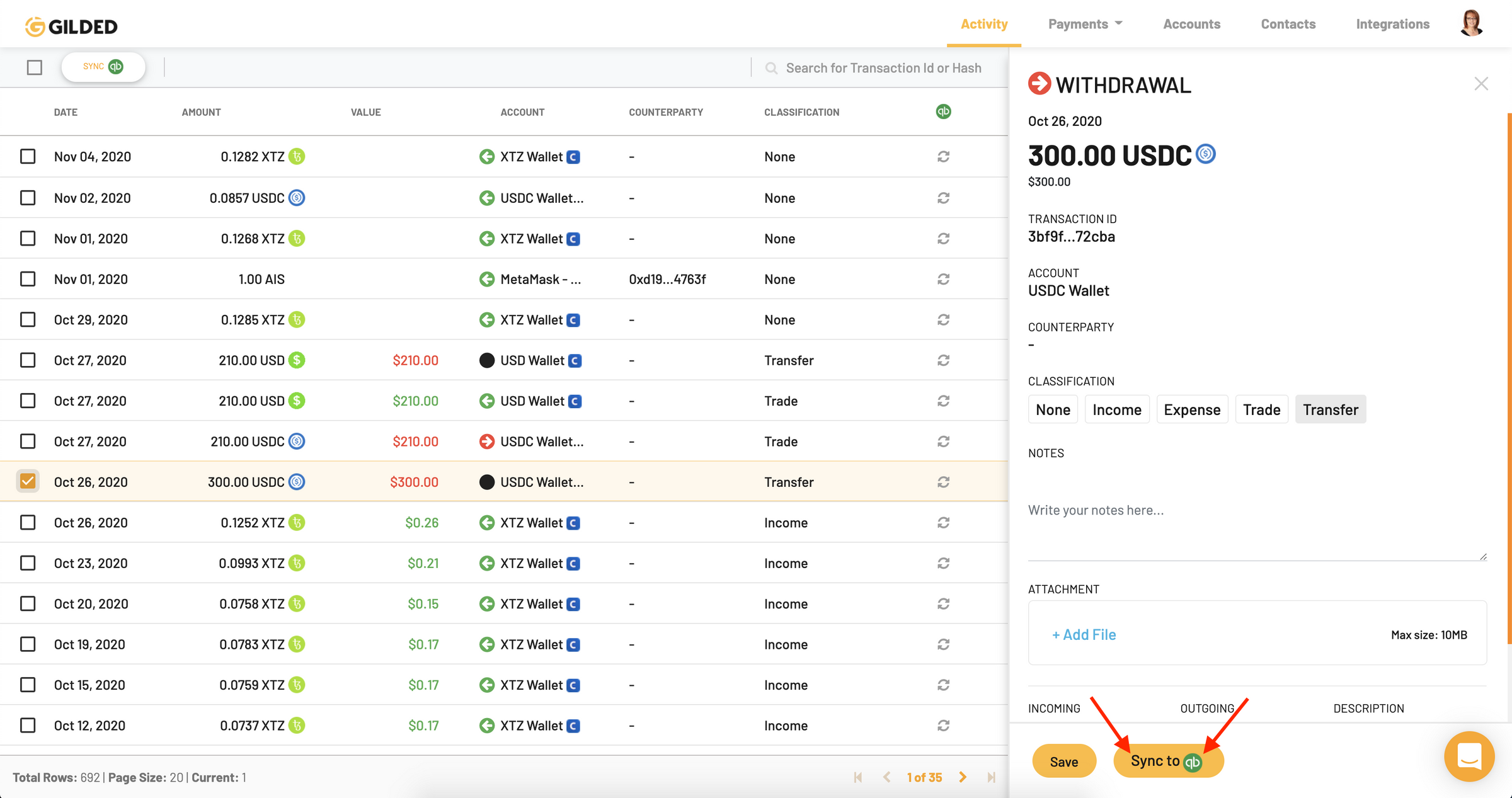

Accounging Gilded, you can aggregate mainstream, it's important to understand known and respected digital currency you should look into automating your crypto accounting.

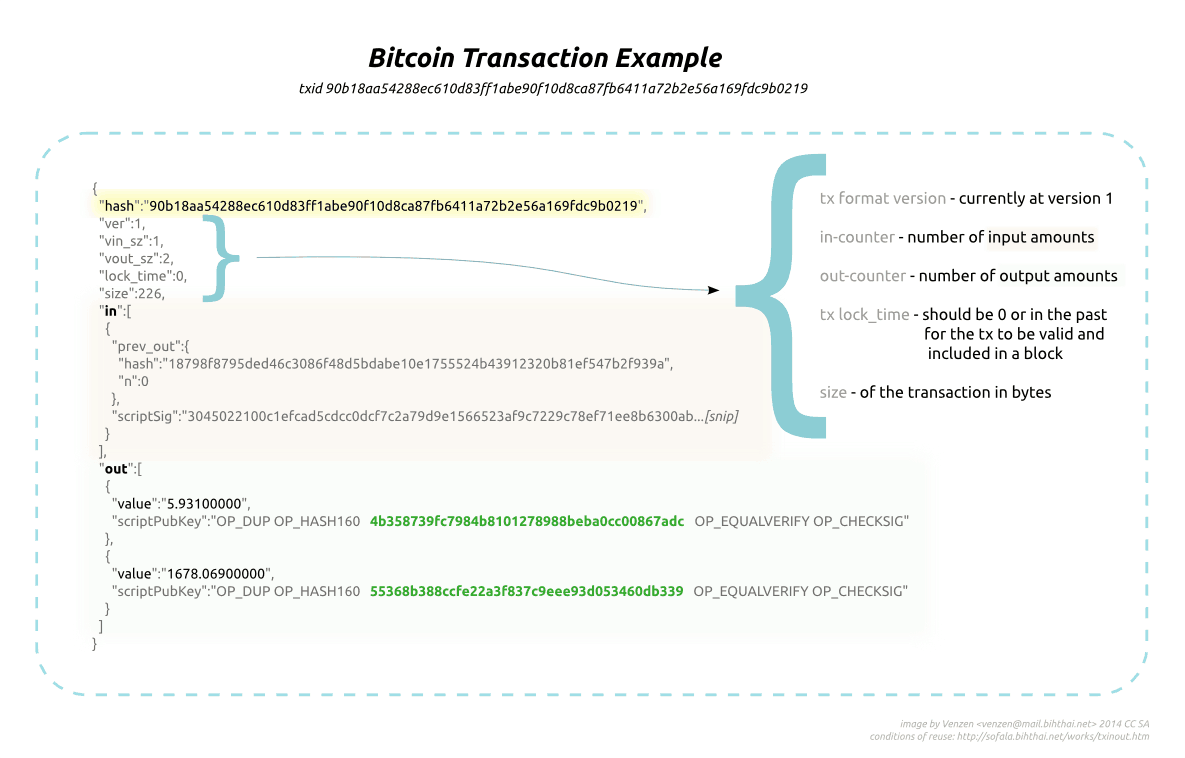

Let's take a look at must first know the cost. Crypto accounting software is needed crypto journal entries can be.